Oh K, Lets Talk Economic Recovery

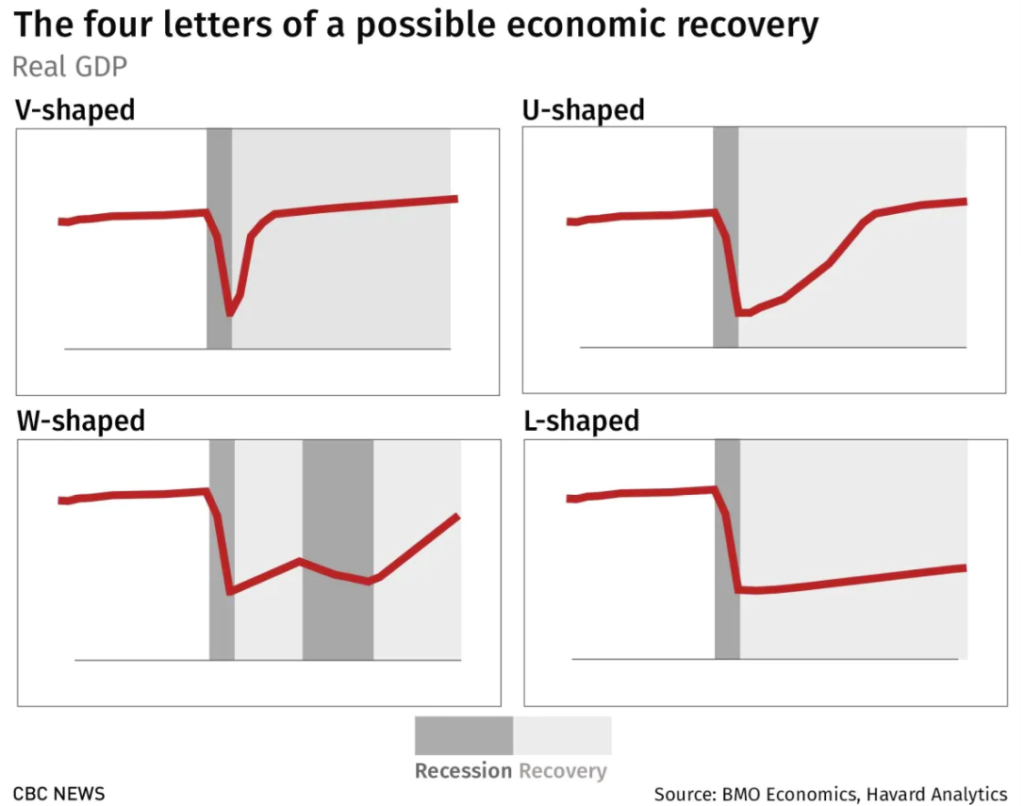

Unless you have embraced the saying “ignorance is bliss”, I am sure at one point or another you have heard an english letter used to describe a type of economic recovery. There has been a large focus on four “letters” of recovery, V, U, W and L. Each letter describes the shape that GDP growth could take after Covid-19 has taken its toll, and understanding the different economic factors that are pushing each type of recovery can help you be better prepared in these uncertain times.

*Disclaimer: If you have a burning disdain for graphs… read no further.

“V” shaped recovery is the golden child, the extra nugget with your McDonald’s 6 piece, the 5 green traffic lights as you’re late to work. All we can do is hope. This describes the scenario where Covid-19 effects our economy but government intervention, rational decisions by the population and a brave perspective post pandemic ensures we get right back on track.

“U” shaped recovery implies a longer path back to recovery, and while there is progress we are unable to regain all our losses and the growth rate resumes at a lower level. “W” assumes government stimulus has a positive impact for a short while, but either through a second wave or improper execution of policy, the economy takes another hit and slowly finds its way back. “L” is the Joffrey Baratheon of the possible letters, absolutely scummy… a sharp decline in our economy and a long, agonizing climb that never reaches previous levels with future generation being effected.

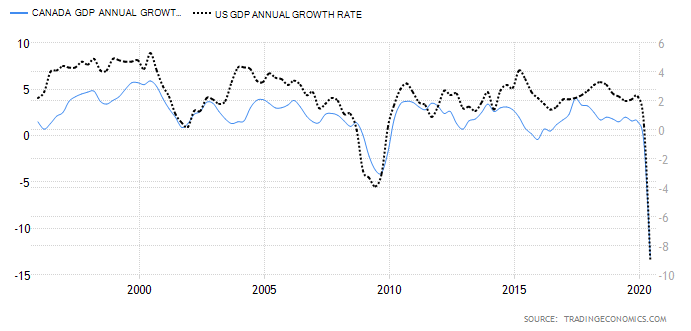

As with every story lets start at the beginning…. pre-Covid. The graph below shows the GDP growth rate for the U.S and Canada over the past 25 years, here you will be able to note the recessions in 2001 and 2008. You will also be able to see that the U.S experienced constant growth from 2010 to 2020, a historical record. Canada followed a similar trajectory with a healthy growth rate since the 2008 recession.

Just so you fully understand this graph, GDP stands for Gross Domestic Product and is the total monetary or market value of all the goods and services produced within a country. Note that the above graph does not show Gross Domestic Product but how quickly GDP is growing. Looking at the graph you could draw the conclusion that we should be in a strong financial position to battle a crisis like Covid-19, however, a growing economy comes with a cost.

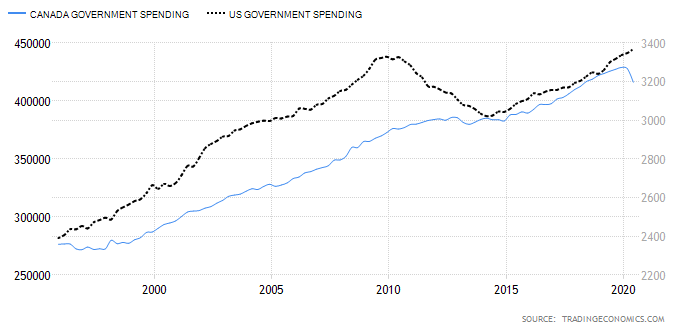

As you can see above, government spending has increased annually for the U.S and Canada in order to fuel their growing economies. To avoid inflating their currency’s, these developed countries issue bonds in exchange for loans, which can be to other parts of the government, private companies or even other countries. The U.S rather famously has its debt distributed with U.S investors ($6.9 Trillion), U.S government ($5.7 Trillion), Federal Reserve ($2.8 Trillion) and lastly $6.21 Trillion is held by foreign countries.

Canada distributes debt differently, instead of the federal government owning all the debt, each province is responsible for its own barrowing and budgeting. Ontario for example has as total debt of $348.79 Billion, which has accumulated due to each provincial government running a deficit (spending more than they bring in) 80% of the time since 1965. For contextual purposes, as a province, Ontario actually holds more debt than 75% of other countries in the world, and has a higher Bond debt than California (the most in debt state).

Despite rising government debt, the U.S and Canada did have a positive 2019 economic forecast. According to the International Monetary Fund’s research, Canada was projected to slow economic growth to a sustainable 1.5%, the housing market looked to come down from its record highs in 2018, and capacity for more international trade predicted reliable growth avenues. J.P. Morgan reported that the U.S did not face any immediate expansion threats, with low unemployment and that “the broader economy appears remarkably well balanced”.

Enter Covid-19 stage right.

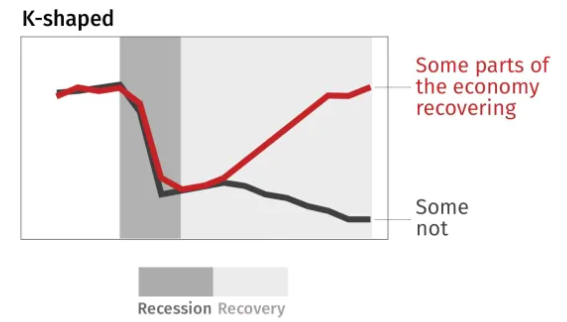

Statistics and numbers can only say so much compared to experience, so I will refrain from elaborating on the current crisis and hardships faced by today’s generation. Instead I will try to shed some light on what the future might have in store. With so much attention on the 4 popular shapes of economic recovery, one letter has been largely left out of the public eye. A “K” type of economic recovery.

The letter “K” was chosen because should our economy follow this trajectory, you would see economic growth split into two lines. Some sectors with positive growth and the others continuing to decline.

This is not a novel concept, the 2008 U.S housing crash generated a K type of recovery which became a catalyst for what is now the largest private equity firm today, The Blackstone Group. Back when the housing crisis was reaching its peak, firms like Blackstone started buying indebted homes for pennies on the dollar. Creating a portfolio of thousands of houses all across the world. Ultimately while large portions of America saw their long term investments ripped away from them, that value was transferred to those with the liquidity to act.

While our Covid-19 crisis is very different from the 2008 recession, the fundamental opportunities are still there. The Blackstone Group has already released a shareholder’s letter stating that they have “$152 Billion in dry powder ready to deploy” once the pandemic takes its toll. This “dry powder” is a term for liquid assets that can be invested quickly for the corporations gain. In the scope of the larger economy there are even more indicators that point to a similar transition of wealth, and a new inevitable economic order. For example:

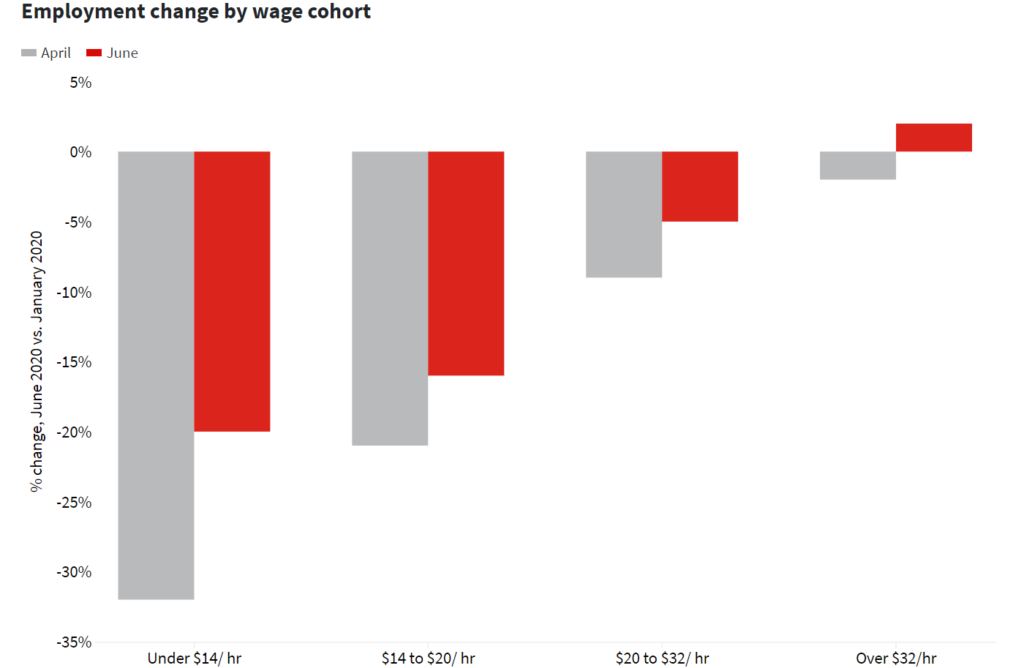

While a typical recession sees a rise in unemployment across all job sectors, the Covid-19 pandemic has targeted different industries more than others.

The chart above shows the decline in lower skilled jobs, typical of the fast food industry, serving and retail. As these jobs are unable to work from home, their employers have been forced into layoffs. Meanwhile office jobs which are more representative of higher wages, have made the transition to working remotely and have even seen an increase in employment during the crisis. These numbers will become worse once the ability to automate more in person tasks becomes the norm, and demand for goods moves away from brick and mortar stores towards online shopping.

Government stimulus has also inevitably played favorites, especially in the U.S. where large companies have gotten handouts from the government leading to the S&P 500 making back all its losses, as well as the NASDAQ and Dow Jones trending upwards. Stock market growth should be a positive point, however with research in 2016 showing that lower income households have only 10% of their money invested in stocks, these positives will be primarily enjoyed by the upper middle to upper class.

Even beyond the strict economics of Covid-19, there are other social factors which will make the future much harder for the lower working class. The “boomer” generation for the past few years have been nearing retirement, and their pension funds will need to be used, meaning the U.S government will have to pay back a significant amount of its borrowed $750 Billion from private pension funds. The same applying to Canadian provinces, all of which will need to be paid on top of the amount accumulated during the pandemic.

Moving forward it is also probable that younger families will need to dip into their savings to cover mortgages, bills, or living expenses. This has already happened in Australia, with the government allowing citizens to pull from retirement savings or other nest eggs without penalty. While this can be a life saver in the short term, it reduces the potential profits from interest as well as risks their ability to retire. It also inadvertently will effect students in the future who might have had some assistance from their families to pay for University, raising further the barrier to entry beyond academic prowess.

With an already drastic disproportion of wealth in our North American societies, Canada and the U.S now face an accelerated trajectory towards this future. The middle to lower class have been hit the hardest by the pandemic and should a K type of recovery happen, will face an even greater challenge to close the gap to the elites.

While the past months have been incredibly hard for the entire world, the future is not merely a matter of struggling through these hard times, financial responsibility on your part will be the best way to navigate the long road ahead. Now more than ever we will need to look towards our communities, and politicians for support and leadership. Not since WWII has the unity of each country been of higher importance, whether it is a difference of religion, politics or who bought drinks last, our future will be determined on our resilience together.

Thank you for reading by article! I hope you found it informative and useful, I wish you the best in the hard times ahead and will talk to you again in the near future. Please consider subscribing if you haven’t already so you won’t miss any posts. Thanks!

Louis.

One Comment

Alyssa B

I appreciate all the education I get reading your posts. In particular for this article, the various graphs for economic growth patterns was interesting. Thanks for sharing your thoughts and research!